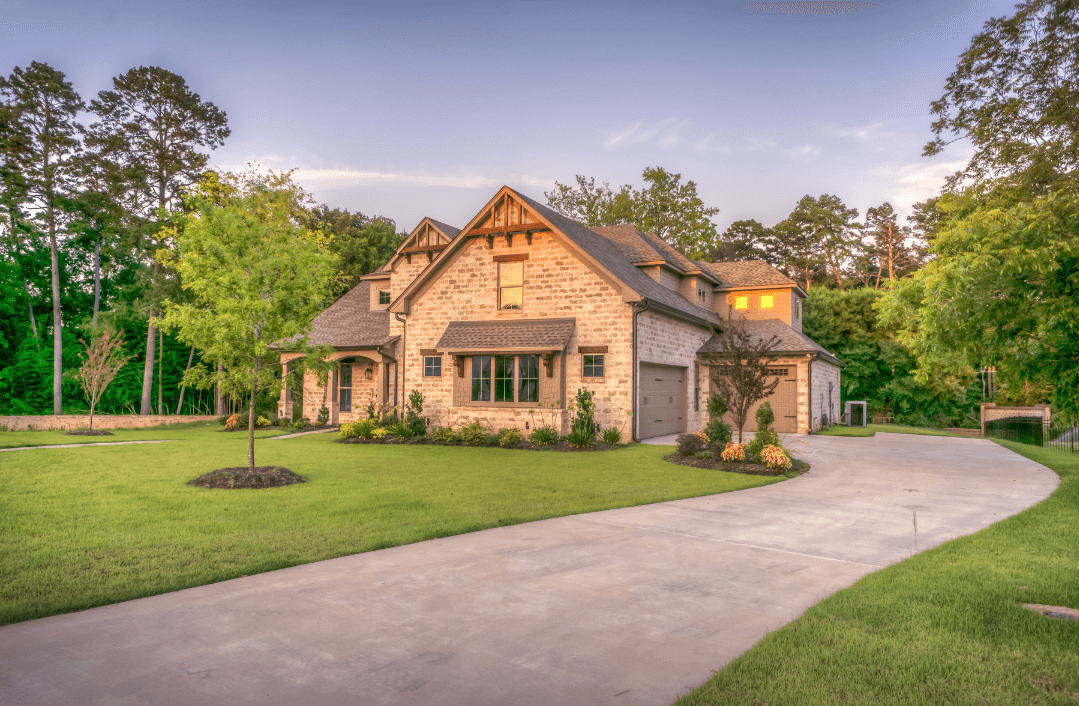

A home is often one of the most valuable items of property that someone will ever own. When it comes to ensuring that your home passes to the individual or group that you intend, there are a variety of ways to legally make that happen. The life estate is a less commonly used method.

What is a life estate?

A life estate, sometimes called a right of occupancy, is a property law concept that allows a property owner to split their interest in real estate and other types of property into different types of ownership that can exist simultaneously. For example, the owner of a cabin could legally split their ownership interest in the cabin, allowing them to possess and enjoy the cabin for the remainder of their life and then, at death, automatically pass full ownership of the cabin to a named individual.

How to Create a Life Estate

Using a life estate deed is one way to establish a life estate in your home. This type of deed must be drafted carefully to identify who will own the life interest (the right to possess and enjoy the property during their life) and who will receive the remainder interest (the right to receive the property when the individual owning the life interest dies).

Once a life estate deed is properly drafted, signed, and notarized, it should be recorded in the appropriate land records office to give it full legal effect. After recording the deed, the individual with the life interest (or life estate) can use and enjoy the property throughout the remainder of their lifetime. Note that the life interest holder is typically responsible for maintaining the property as well as any property tax liabilities.

Using a trust is another way to create a life estate. For example, a property owner could title their home in the trust’s name and, through the trust language, designate who will have the right to use and enjoy the property during life and who will receive the home at the life interest holder’s death.

Benefits of Using Life Estates

Probate avoidance. Whether you are using a life estate deed or a trust to create this type of split interest in property, probate avoidance is one of the major benefits. Probate is often an expensive, time-consuming, and public process for passing accounts and property to your loved ones. Using a life estate deed or a trust as a part of your estate planning can be an effective way to avoid involving your state’s probate court system in passing your property on to the individuals and groups that you want to receive it. Beyond merely avoiding probate, life estates can create additional flexibility in how you pass your property on to your loved ones by resolving competing interests among beneficiaries.

Second marriages. A life estate can be particularly helpful when someone in a second (or third or fourth) marriage wants to allow their new spouse to continue to live in the family home until the spouse dies (life interest), with the home ultimately passing to the original owner’s children (remaindermen). This arrangement can ensure that both your current spouse and your children from an earlier marriage can enjoy the property as you intend, rather than the property passing to someone whom you never intended to receive it (such as a new spouse who comes into the picture after you have died or your stepchildren instead of your own children).

Medicaid planning. A life estate in property can also be useful in a Medicaid planning context. The homeowner may want to continue to live in their home as long as possible but may not want their home to be sold to repay Medicaid if they should ever need to go into a nursing home and rely on Medicaid to pay the nursing home expenses. In that case, they could record a life estate deed that reserves a life estate in the home with the remainder interest passing to their loved ones. When that deed is recorded, the interest in the property would be effectively split, and if the Medicaid look-back period is satisfied (five years in most states), the value of the remainder interest would not be included in the original owner’s assets for Medicaid qualification purposes.

It is important to note, however, that states can vary as to how they treat life estates for Medicaid qualification purposes. Using life estate deeds when planning for Medicaid eligibility can be an effective tool, but you should never undertake such planning without the careful guidance of an elder law attorney who is familiar with your state’s rules.

Drawbacks of Using Life Estates

Even though there are some definite benefits of using life estates in your planning when the situation calls for it, there are also some potential drawbacks that you should consider.

First, when you create a life estate in a traditional life estate property deed, you are creating a type of joint interest in that property that cannot be undone without the joint owner’s consent. For example, if you created a life estate for yourself in your own property with the remainder interest passing to your sibling at your death, you could not sell or borrow against the property without your sibling’s consent. Likewise, if you decided that you were angry with your sibling and wanted to make someone else the property’s remainder beneficiary, you could not change the remainder interest without your sibling’s consent. (If your state authorizes the use of a special life estate deed called a lady bird deed, however, you are able to change the remainder beneficiary without their consent.)

Second, as mentioned above, the individual owning the life interest will generally be responsible for the expenses associated with maintaining the property, including taxes. If the life interest owner is unable to afford such expenses, the remainder beneficiaries may not receive their full interest at the lifetime beneficiary’s death because there may be tax liens or other encumbrances on the property before it can pass via the remainder interest.

Third, a pure life estate interest does not protect the remainder interest from the remainder beneficiaries’ creditors. For example, if the life interest owner dies when a remainderman is going through a lawsuit, a bankruptcy, or a messy divorce, that person’s remainder interest could easily be seized by an opposing party to satisfy the remainderman’s debts or other legal obligations. In such a case, a trust with asset protection provisions would be a more effective tool for protecting the remainder beneficiaries’ interests from such threats.

Conclusion

Life estates can be an effective and straightforward method for accomplishing certain estate planning goals, but they are not necessarily the right tool for all situations. Talk to your estate planning attorney to determine whether life estates make sense in your particular situation and to get help properly implementing this powerful strategy.

Tagged with: life estate, medicaid, probate

Posted in: Estate Planning, Funding, Real Estate